Practice management software that works for you

Carepatron's practice management software offers a comprehensive solution tailored to your healthcare team's needs. It streamlines operations optimally with features like unified workflow management, customizable clinical notes, and an integrated patient portal. Experience the benefits firsthand and optimize your practice today, all within a Carepatron login.

The free medical practice management software for your healthcare team

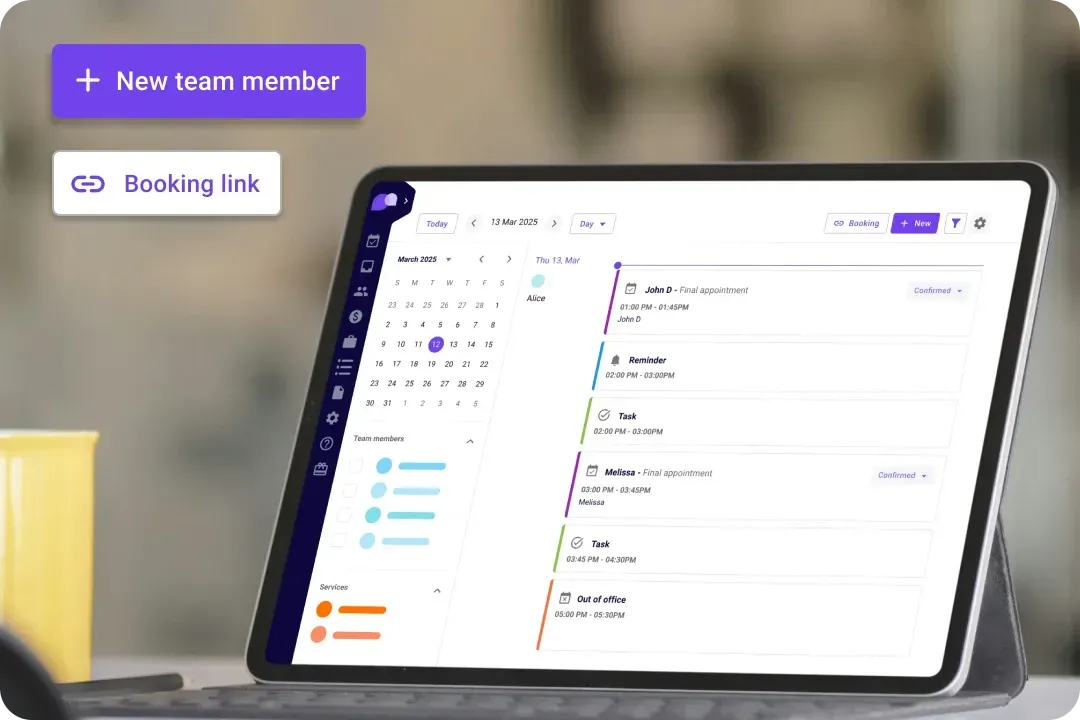

Elevate your healthcare team's efficiency with Carepatron's comprehensive practice management system. Designed collaboratively with healthcare providers, our software equips your business with essential tools for success. Streamline workflow by syncing staff calendars and organizing schedules, meetings, and tasks seamlessly. Here is why it stands out:

Efficient task management

Effortlessly distribute tasks among your team members utilizing our advanced physical therapy scheduling software. Stay organized and enhance collaboration by ensuring everyone is informed with real-time updates and seamless communication.

Access anytime

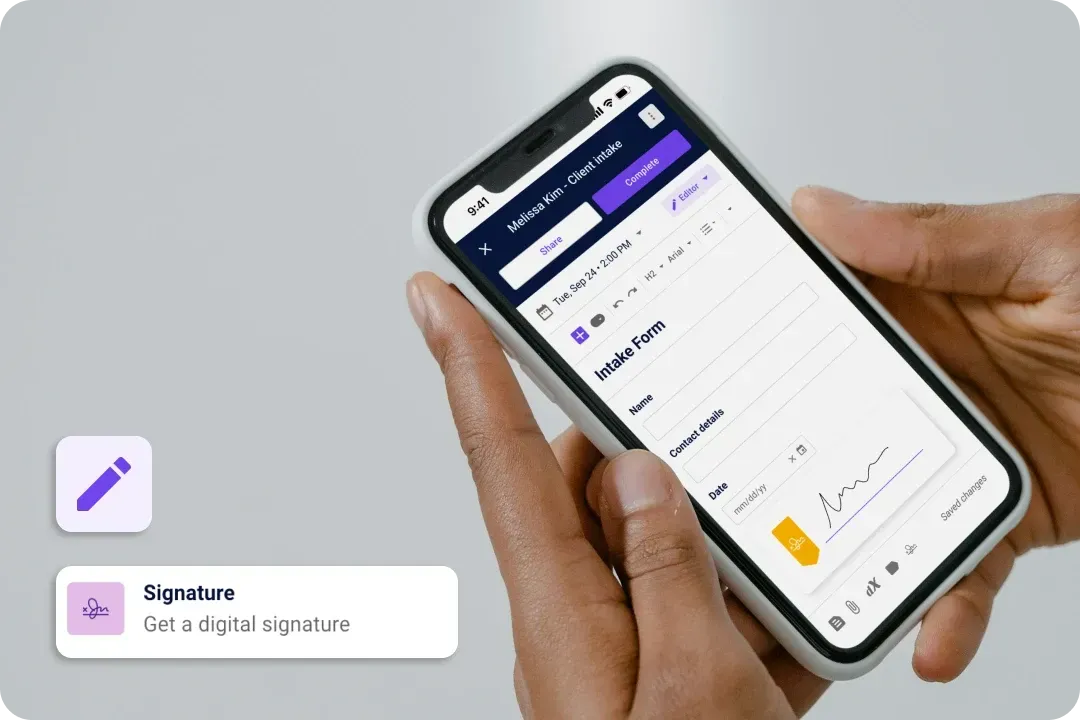

Whether via desktop or mobile, you can access our software anytime, anywhere. Never miss a beat, and stay on top of patient care with our user-friendly interface.

Extensive terminology library

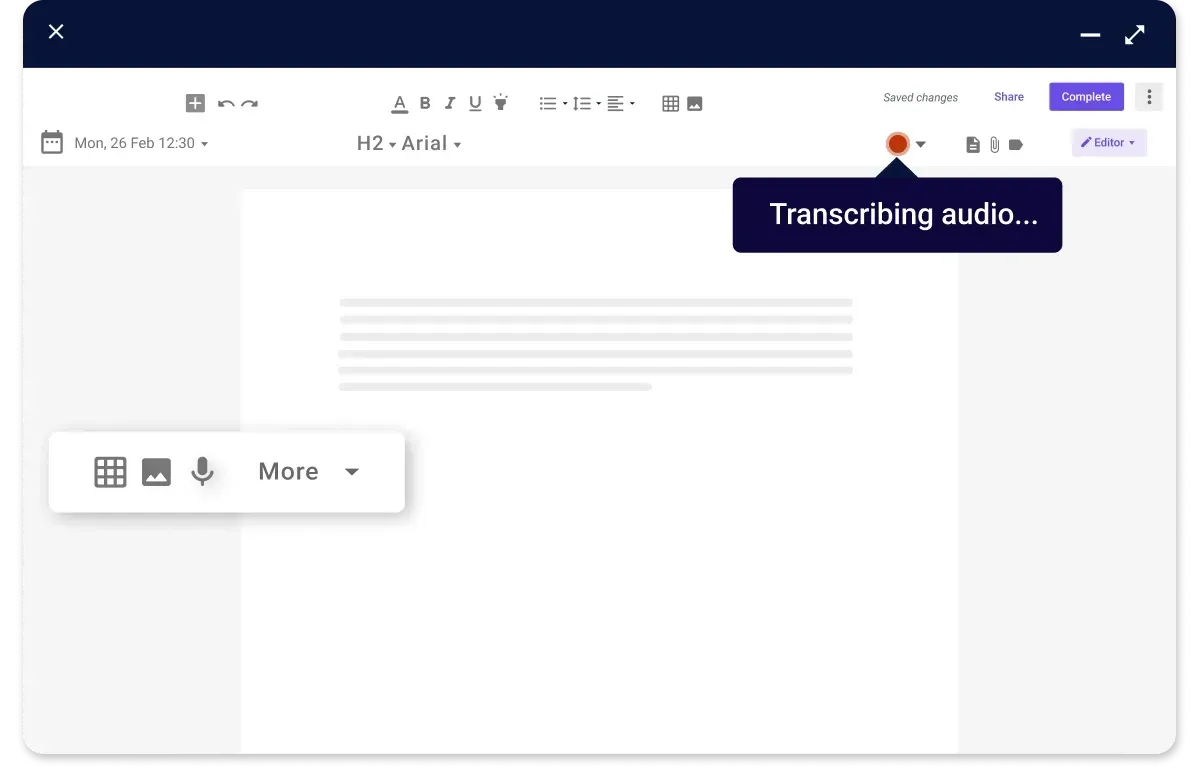

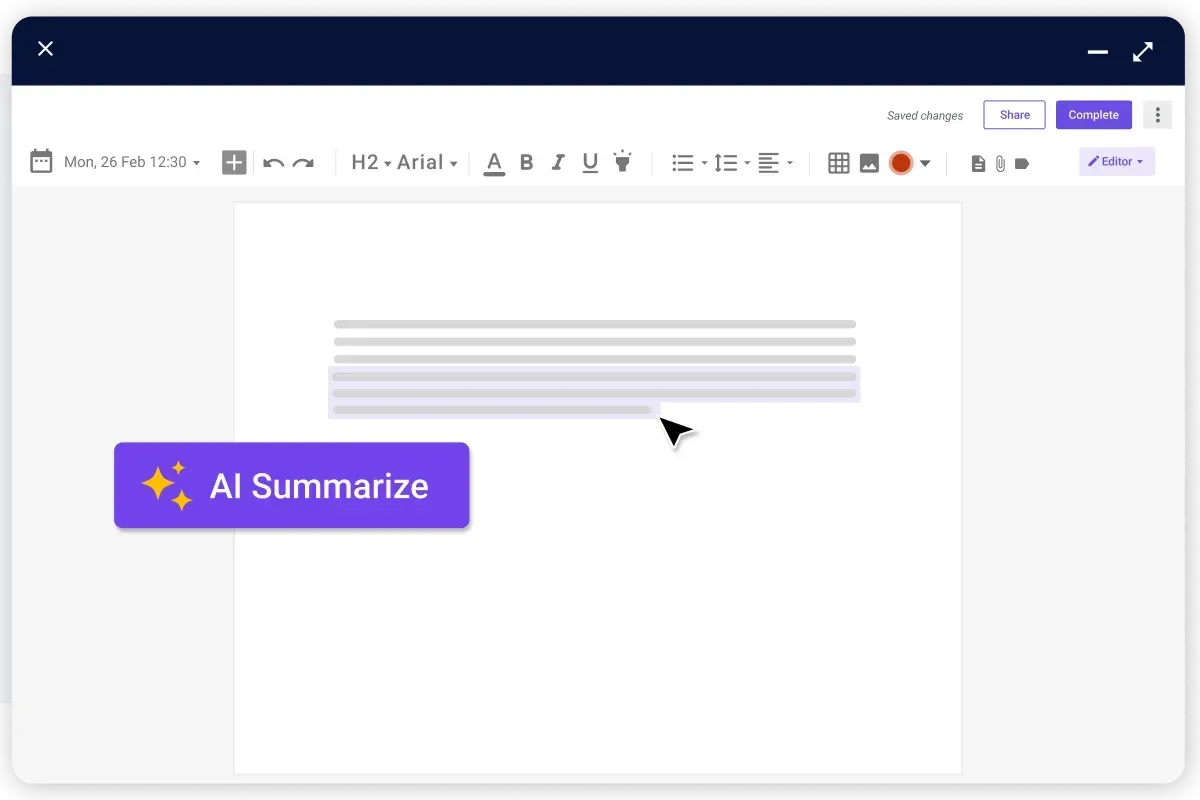

With a comprehensive medical terminology library, Carepatron ensures that all specialized terms and phrases commonly used in healthcare are recognized and accurately transcribed, minimizing the risk of misinterpretation and improving the quality of clinical documentation.

Boost productivity and efficiency

Dive into a world of electronic clinical notes, automated scheduling, and telehealth features! Our software cuts through manual tasks, freeing up your time for what matters most – patient care.

Carepatron’s medical practice management software features

Discover the power of Carepatron's practice management features tailored to streamline your healthcare operations. The software allows you to access multiple tools to boost productivity and increase efficiency. Here are some features:

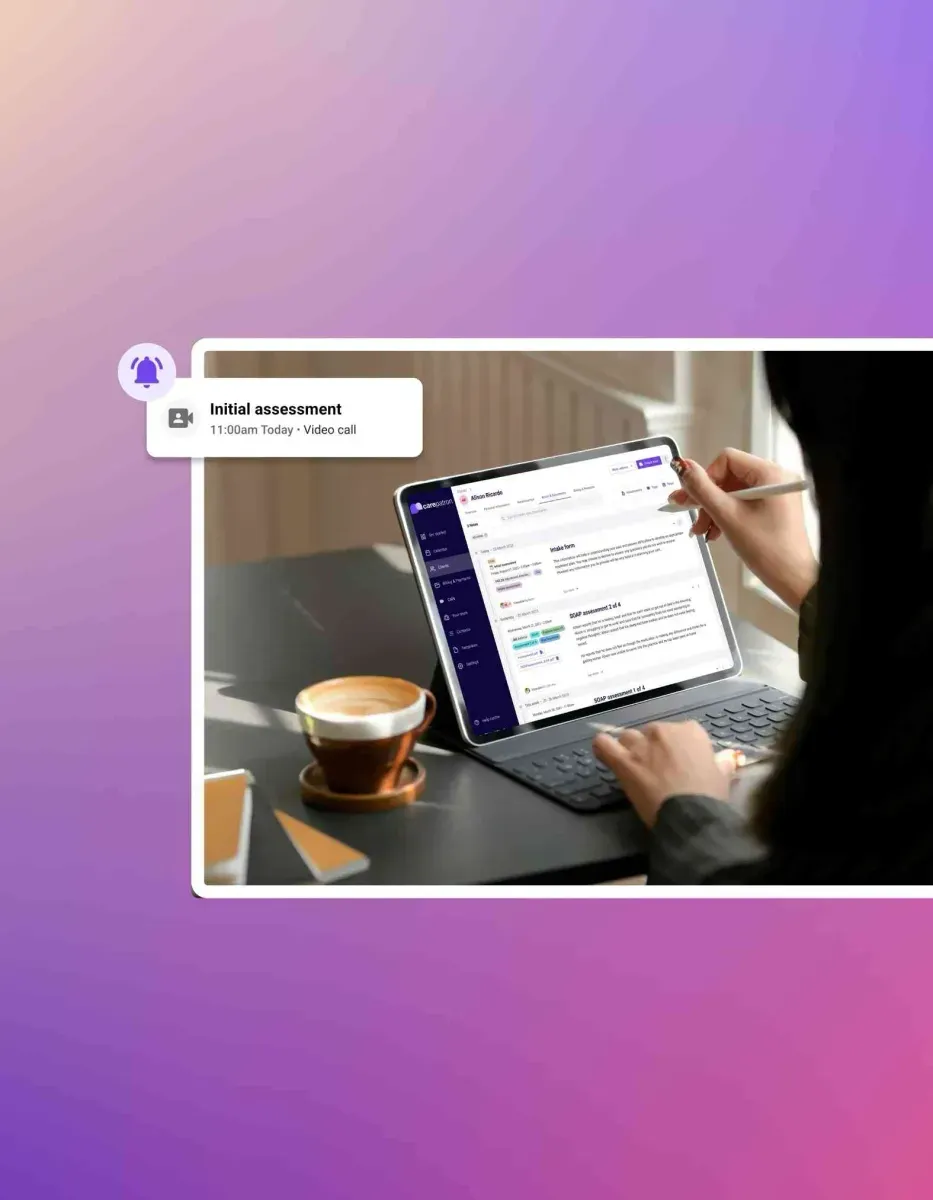

Customizable forms for quicker data collection

Create custom forms for patient intake, consent, and assessments. Collect essential data efficiently and securely with our flexible form-building feature. Make clinical documentation a breeze for you and your team.

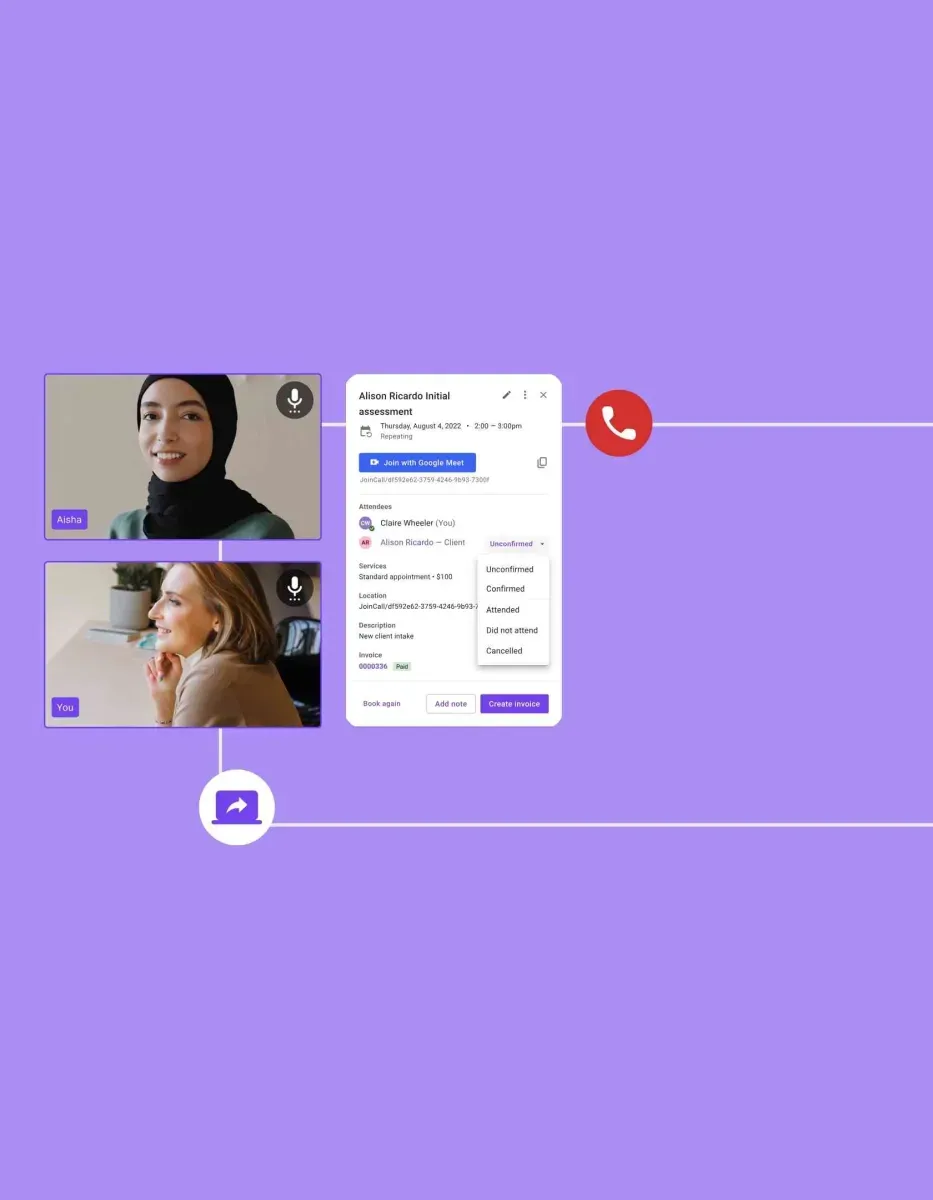

Integrated video calling

Enhance virtual services with Carepatron's integrated video calling feature. Conduct remote coaching sessions efficiently, providing a seamless experience for you and your clients.

Trusted by more than 100,000 practitioners

"It’s so easy to connect with my staff"

CLAIRE, PHYSICAL THERAPIST

"Carepatron saves me 2 hours everyday"

AEGEUS L, HEALTH COACH

"My team loves how simple it is to use"

ANDREA MAGNUS, PRACTICE MANAGER

Practice management software for different practitioners

Carepatron's practice management software caters to a diverse range of healthcare practitioners, including physicians, therapists, dentists, and chiropractors. Whether running a solo practice or managing a team, our intuitive platform simplifies administrative tasks, improves workflow efficiency, and enhances patient care.

24/7 support

Our stellar support squad is here round-the-clock, every day of the week, ready to help you with any queries or concerns. Your satisfaction is our top priority as we strive to deliver an exceptional user experience.

Continuous innovation

Carepatron remains at the forefront by embracing continuous innovation. Regular updates and new features ensure that health coaches benefit from the latest advancements, making it the go-to solution for staying ahead in the dynamic field of health coaching.

Streamlined workflow management

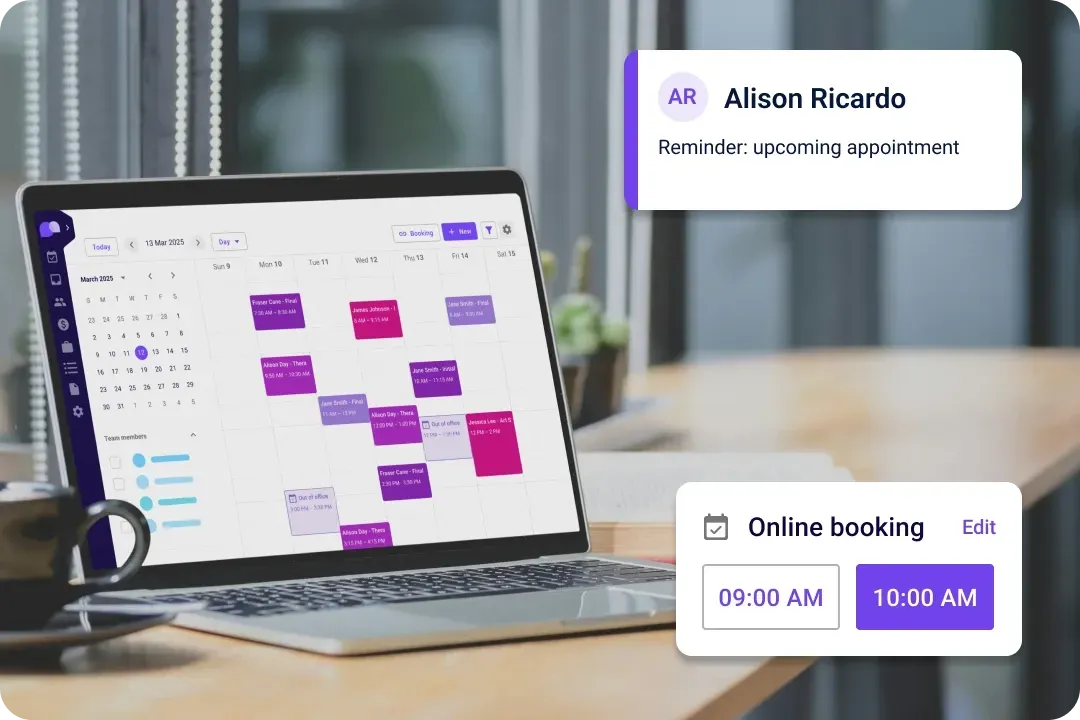

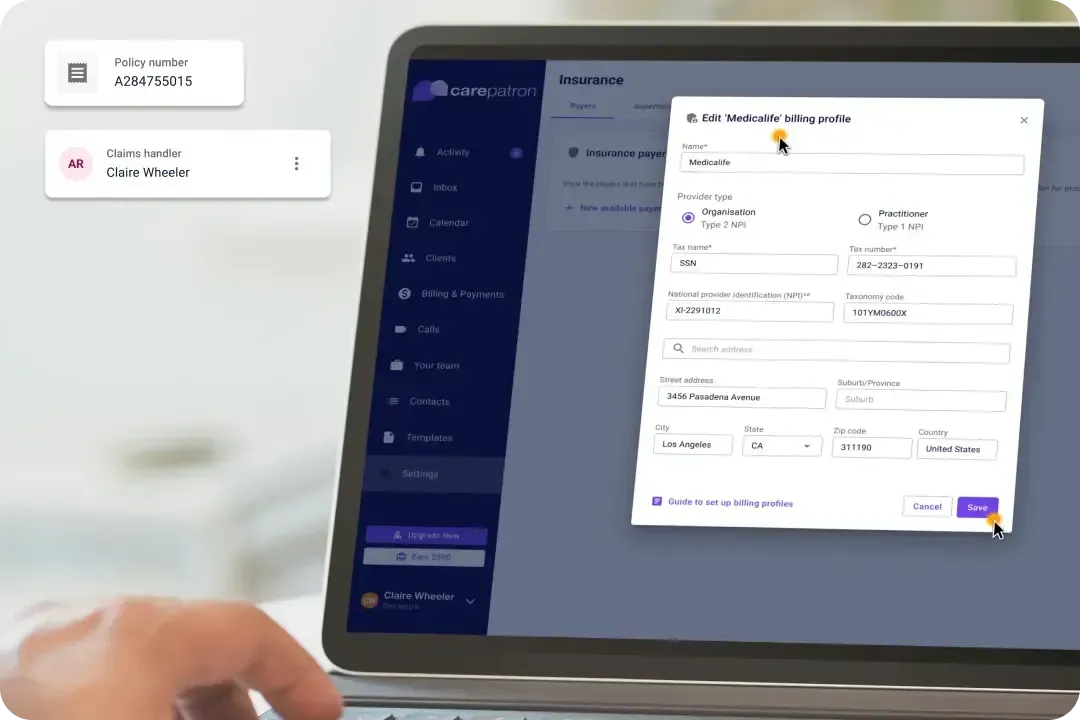

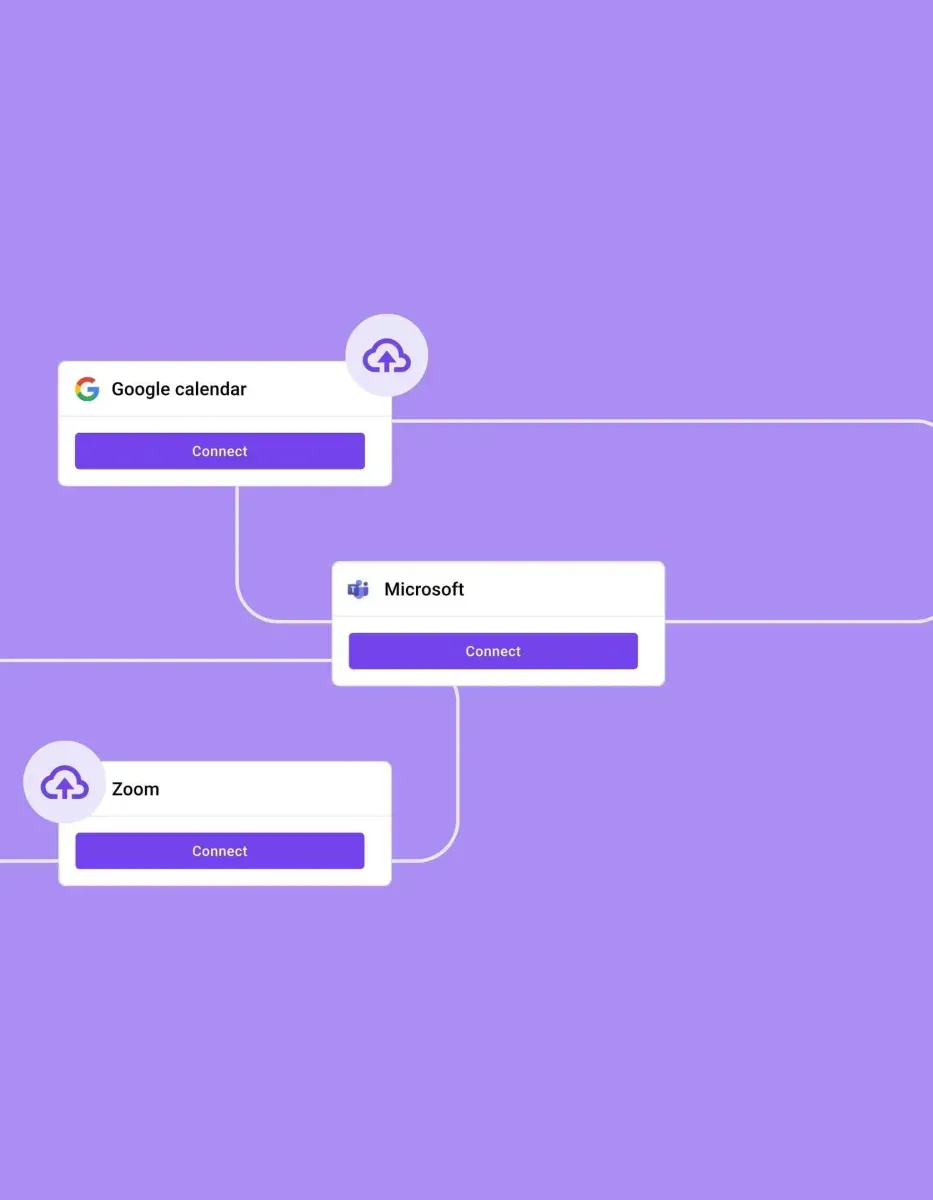

Carepatron's practice management software streamlines workflow by syncing staff calendars and organizing schedules, meetings, and tasks in one unified platform. This ensures that everyone is updated and informed, optimizing productivity and efficiency in daily operations.

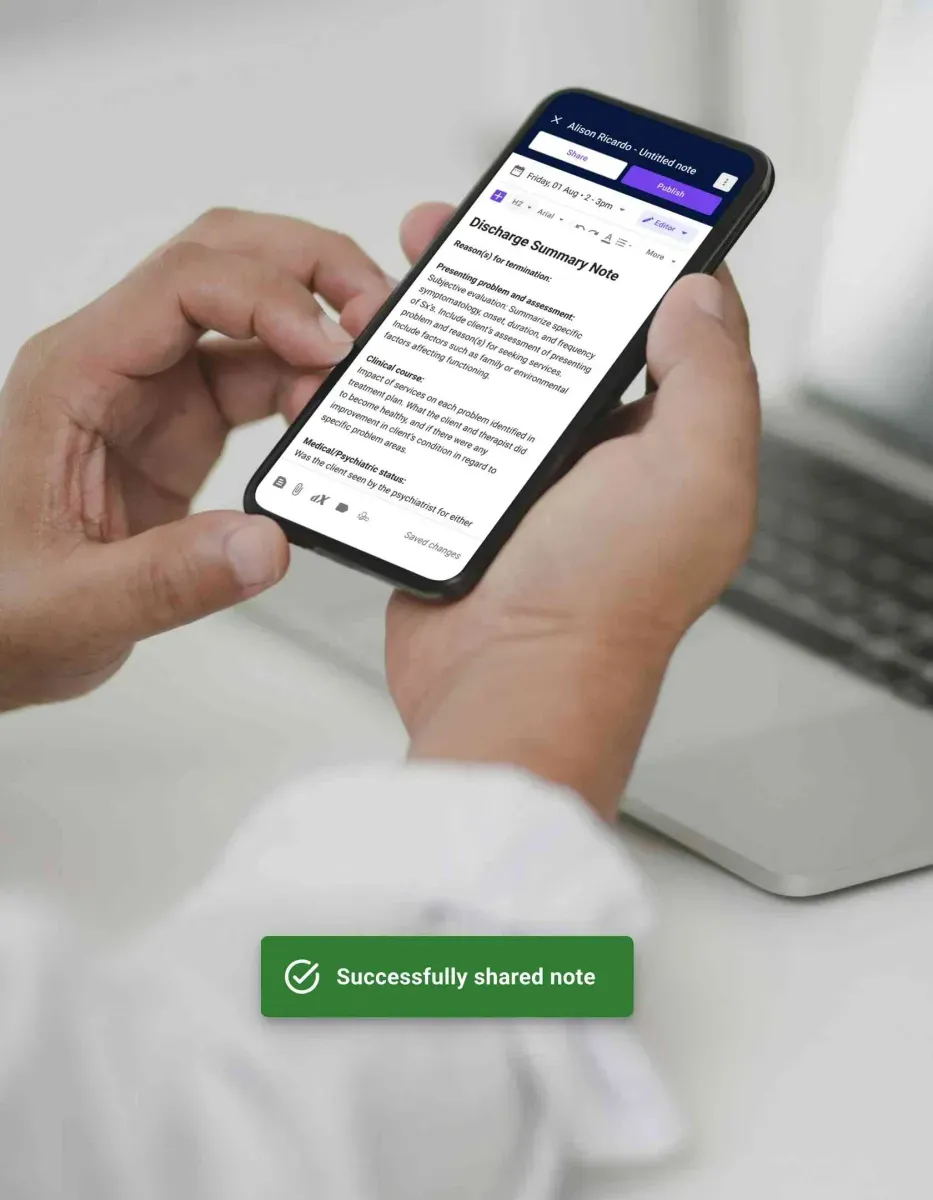

Customizable clinical note templates

Carepatron allows healthcare professionals to create and store clinical notes easily using customizable templates like SOAP and DAP. These notes are securely stored in the cloud-based system, providing simultaneous accessibility and protection while streamlining the documentation process.

The benefits of Carepatron’s practice management system

Experience the numerous benefits of Carepatron’s practice management system, mainly through its telehealth features:

Nurses

Nurses can expedite note-taking processes, ensuring timely and accurate documentation of patient assessments, interventions, and responses for better care coordination.

How to use our practice management software

Carepatron's practice management software free tools streamline healthcare operations with cloud-based technology, ensuring secure data storage and HIPAA compliance. Its intuitive interface and automatic updates keep users updated, and it is accessible on various devices, including mobile phones. Here are the steps for using this software:

Physicians

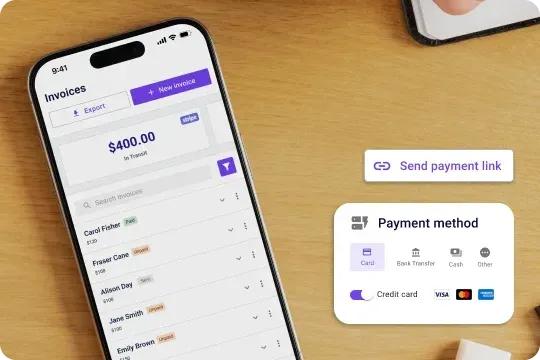

The Healthcare Payment Solution streamlines billing and payment processes for physicians, ensuring timely reimbursements and minimizing administrative burdens. With customizable features and secure transactions, physicians can focus more on patient care.

Therapists

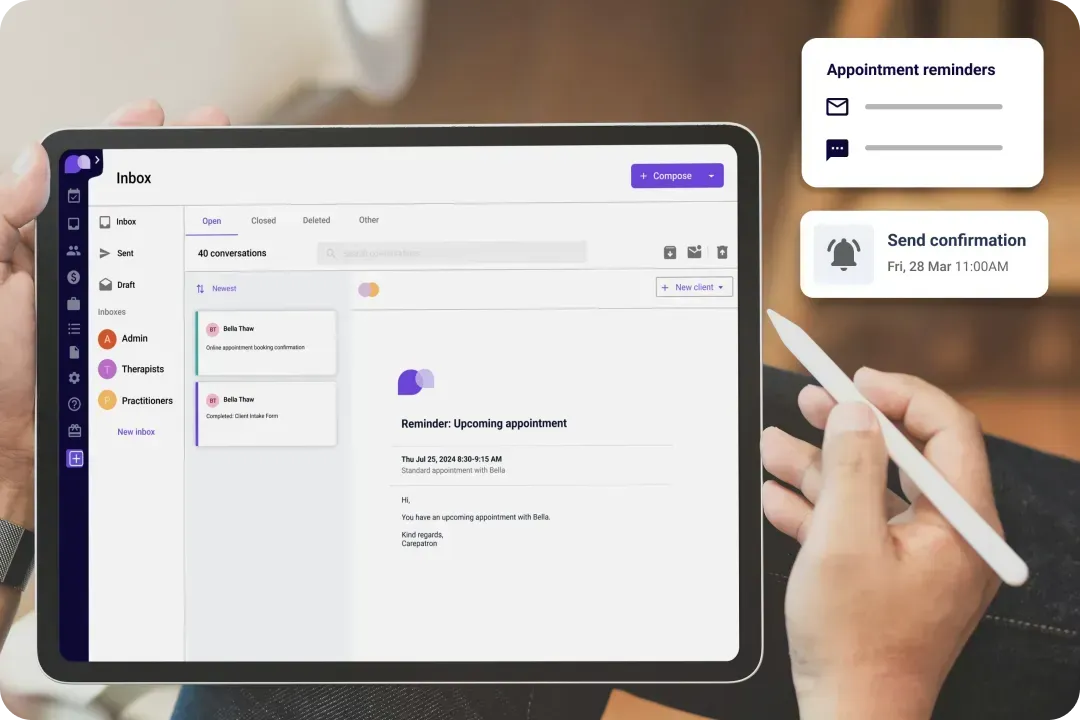

With Carepatron, therapists can efficiently manage appointments, streamline documentation, and engage with patients through the integrated patient portal. This improves communication and ensures a smooth therapy experience for therapists and patients.

Dentists

Carepatron simplifies practice management for dentists by automating appointment reminders, organizing patient records, and integrating billing processes. This saves time and enhances patient satisfaction, ultimately improving the efficiency of dental practices.

Frequently asked questions

EHR and practice management software

Get started for free

*No credit card required

Free

$0/usd

Unlimited clients

Telehealth

1GB of storage

Client portal text

Automated billing and online payments