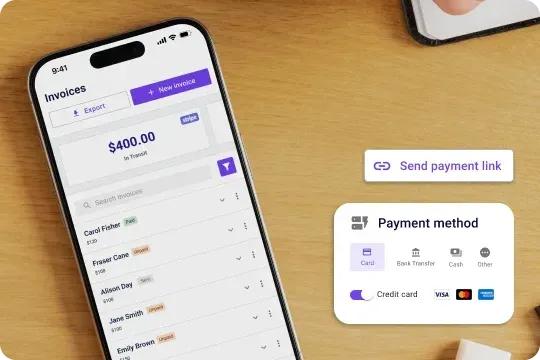

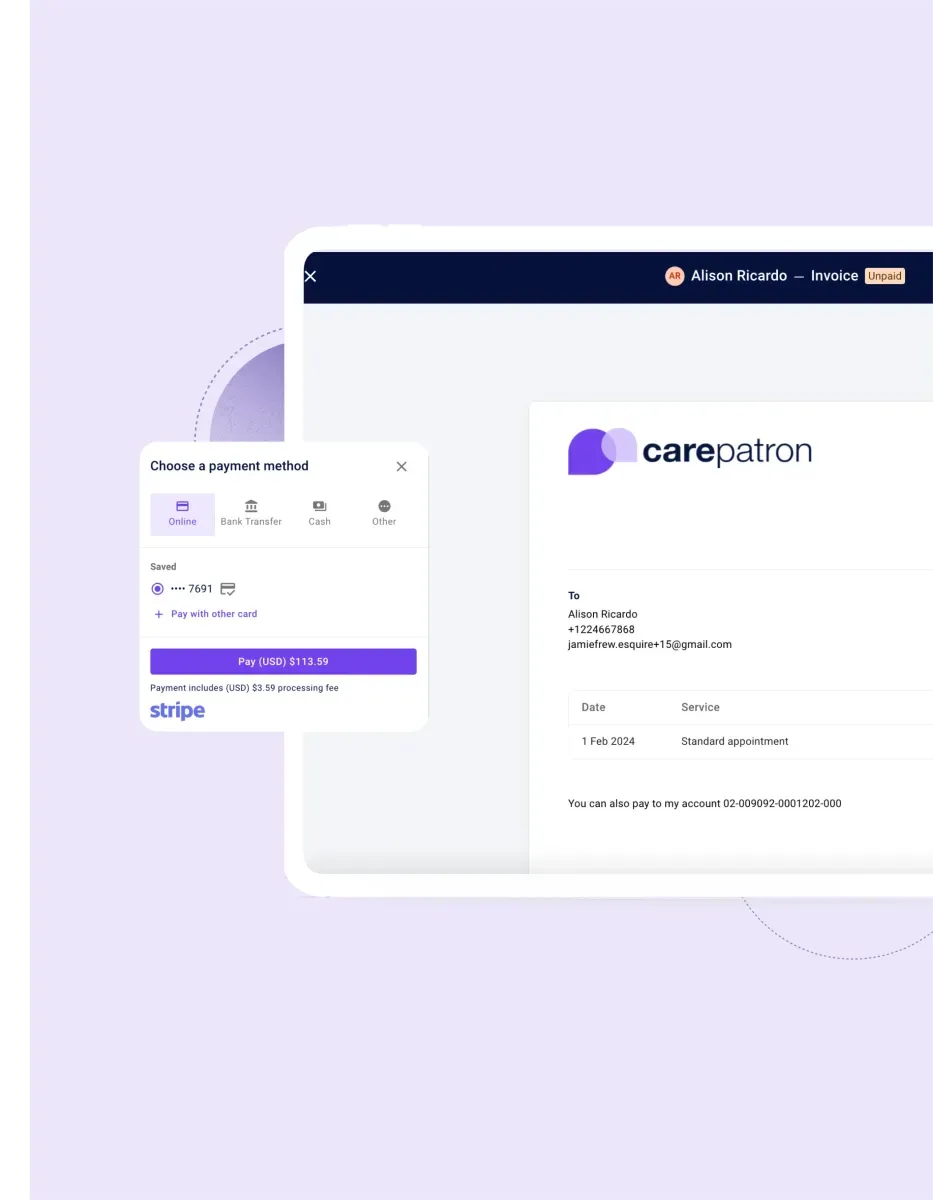

Accept online payments to get paid faster

Get paid faster with less stress. Carepatron’ automates invoices, sends automated payment reminders, and ensures you get paid on time without the admin burden. Plus, it supports various payment methods.

The patient online payments software for your healthcare team

Make payments effortless for your team and patients. Simplify transactions and boost cash flow, patient satisfaction, staff engagement, and profitability.

Robust security

Carepatron prioritizes data security, implementing stringent measures to safeguard patient information and financial transactions. Healthcare teams can trust the platform's reliability and integrity with encrypted data transmission.

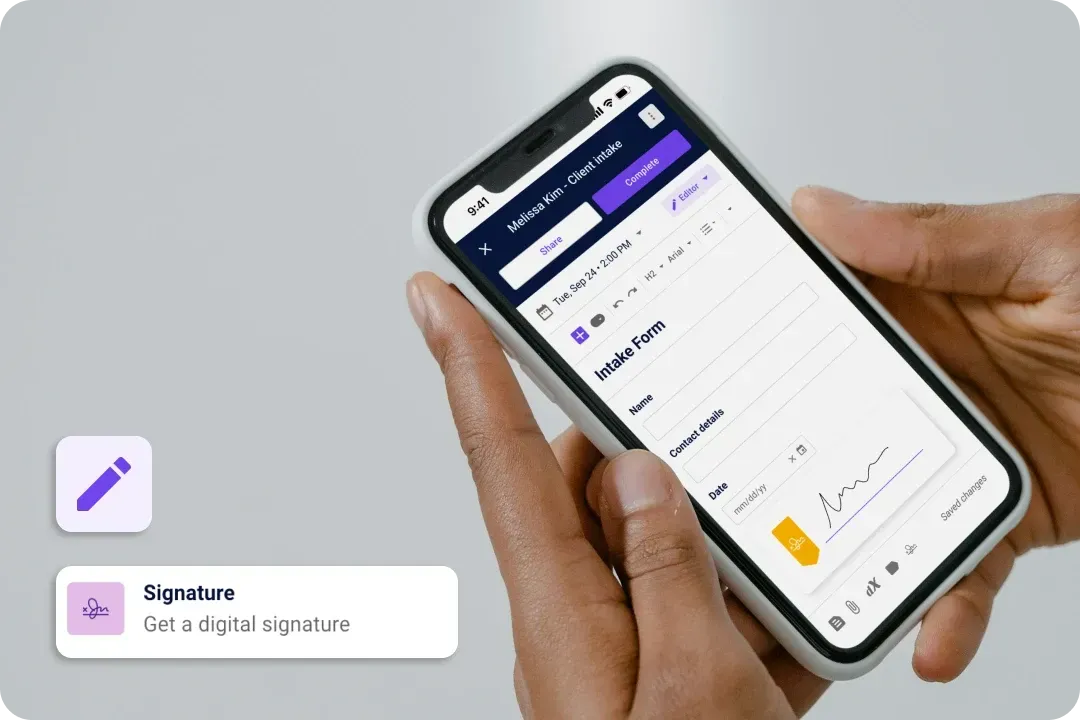

Convenient accessibility

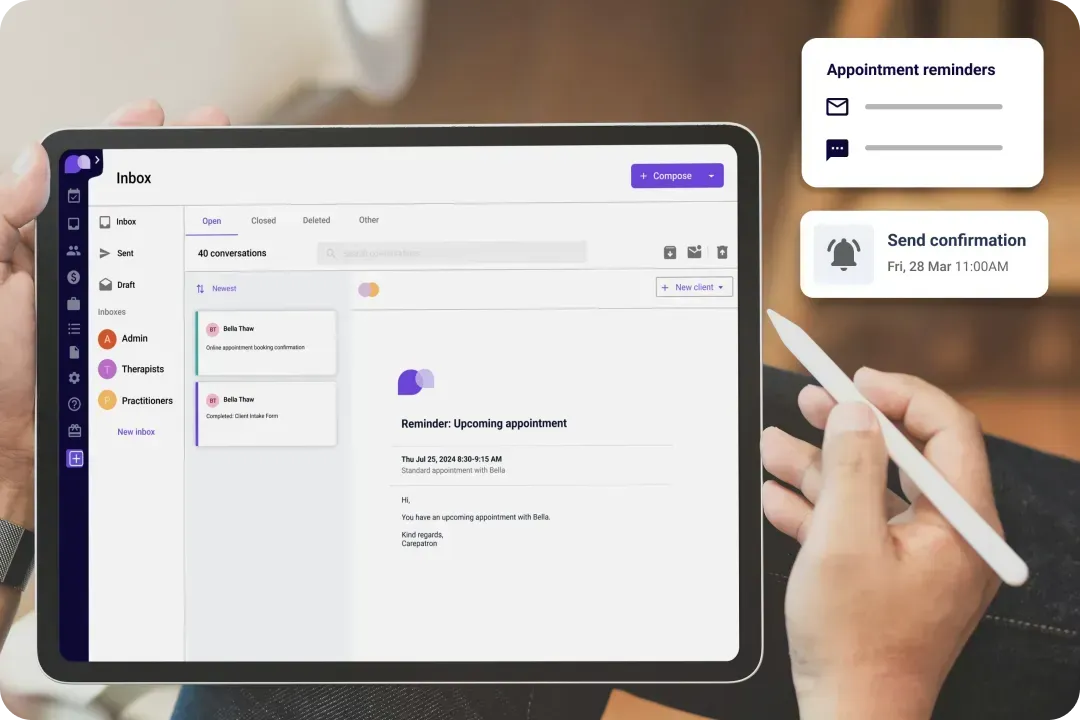

Carepatron's intuitive interface and convenient payment options allow patients to easily manage their bills and invoices online, improving satisfaction and loyalty. Real-time payment tracking and personalized communication enhance the patient experience.

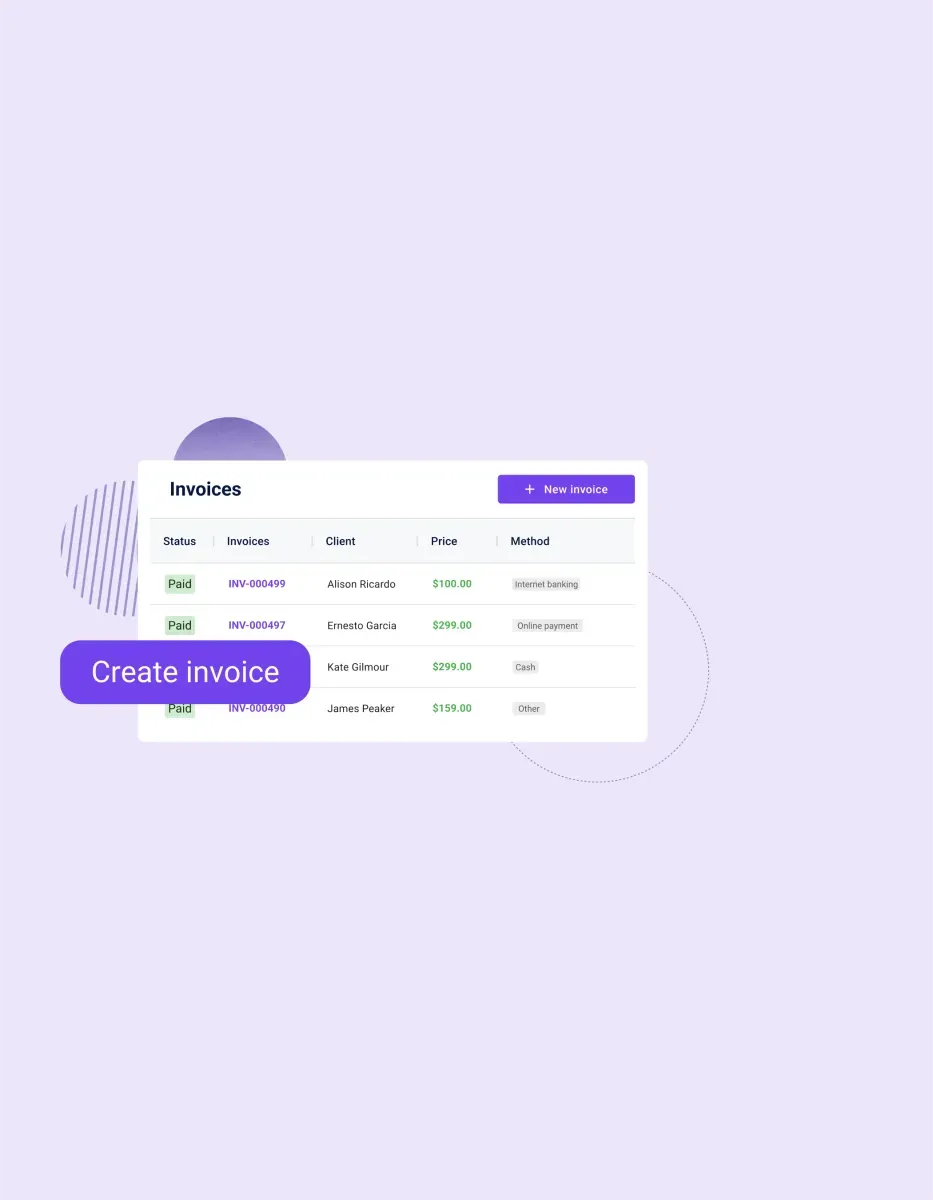

Carepatron’s medical payment software features

Carepatron's medical payment software is designed to streamline your practice's financial processes. With intuitive features such as secure online payments, customizable billing, and real-time financial reporting, managing your medical payments has never been easier.

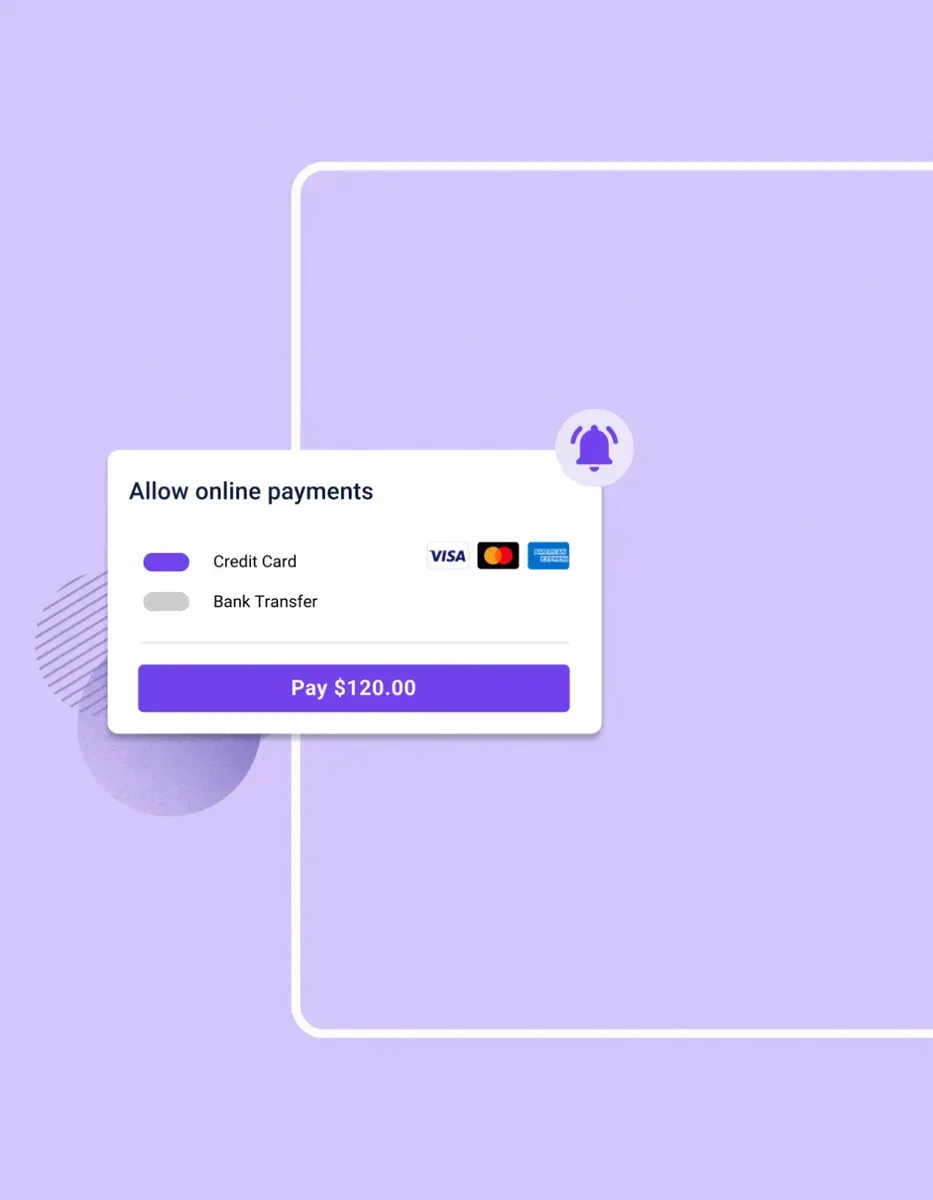

Secure Online Payments

Carepatron prioritizes data security, implementing robust measures to protect sensitive patient information and financial transactions. With encrypted data transmission and secure payment gateways, healthcare providers can trust the platform's reliability and compliance.

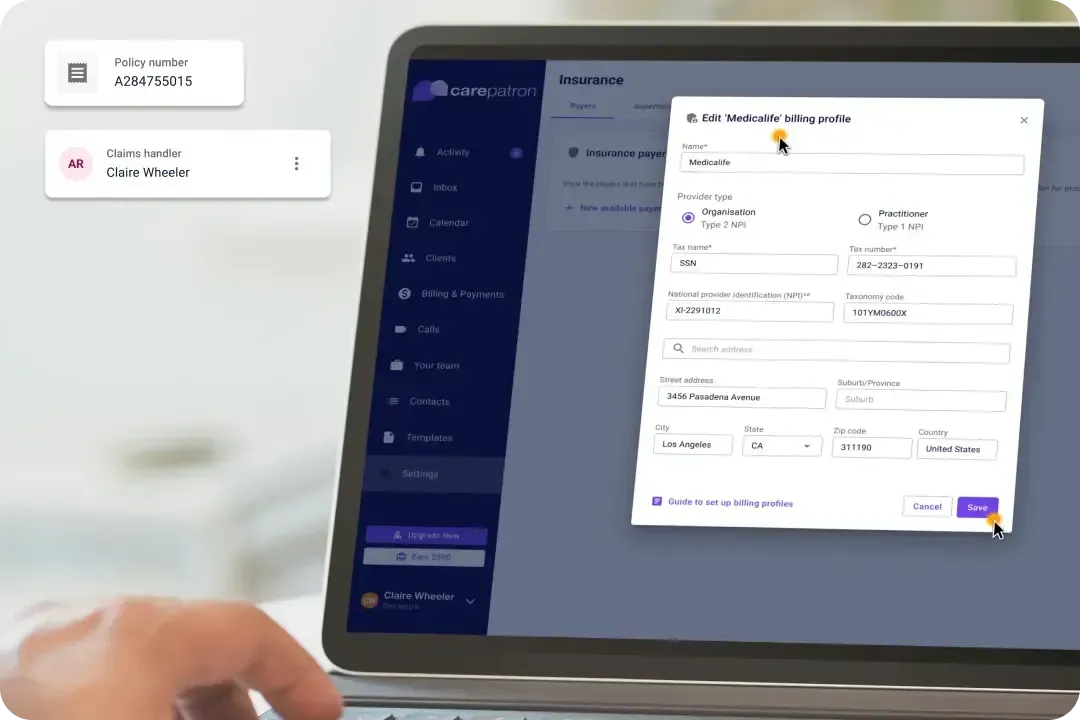

Customizable Billing

With Carepatron, healthcare providers can personalize billing processes to meet their practice and patients' unique needs. From creating custom invoice templates to setting up payment schedules, the platform offers flexibility and control over billing procedures.

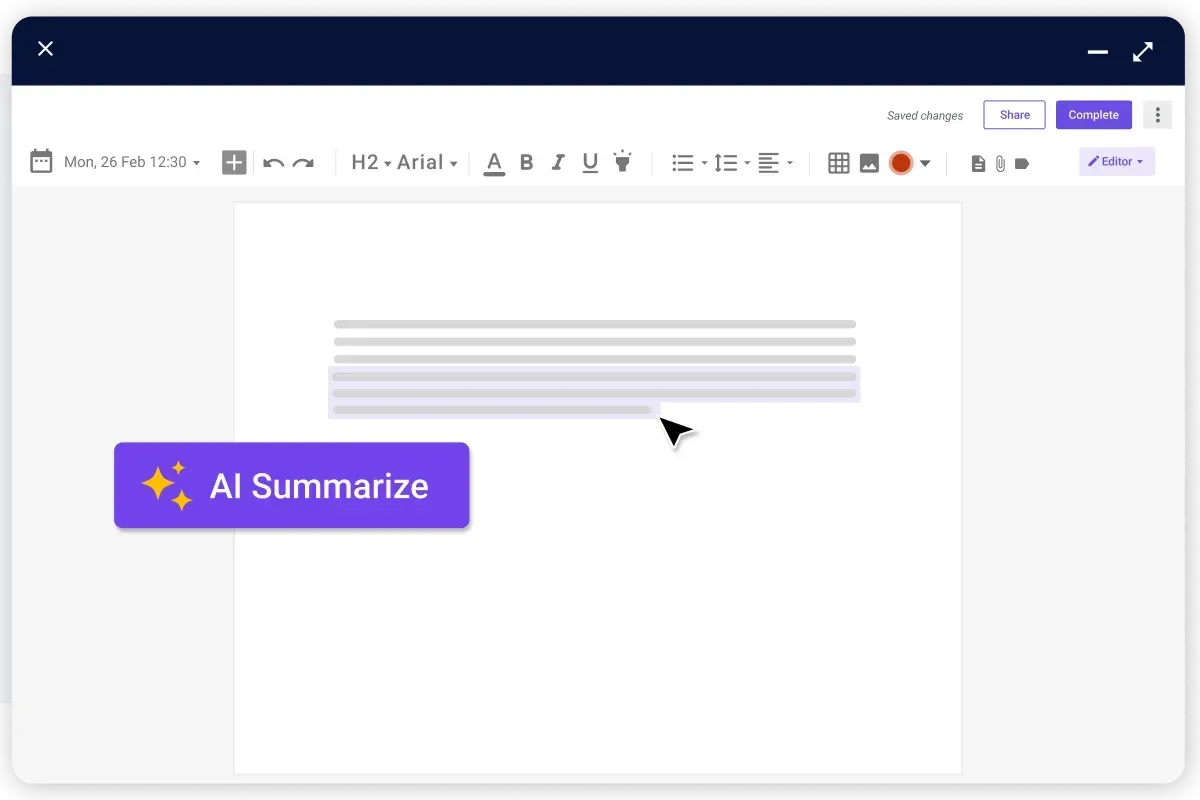

Real-Time Reporting

Carepatron provides real-time reporting capabilities, giving healthcare providers instant visibility into their practice's financial performance. Users can make informed decisions to optimize practice profitability and growth.

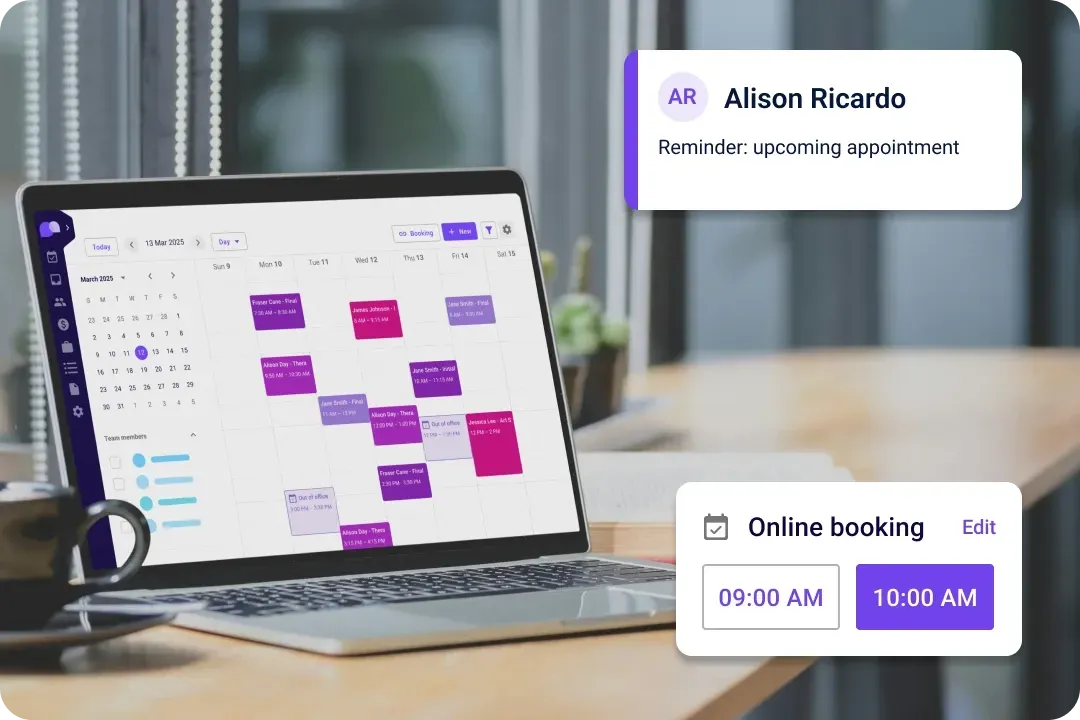

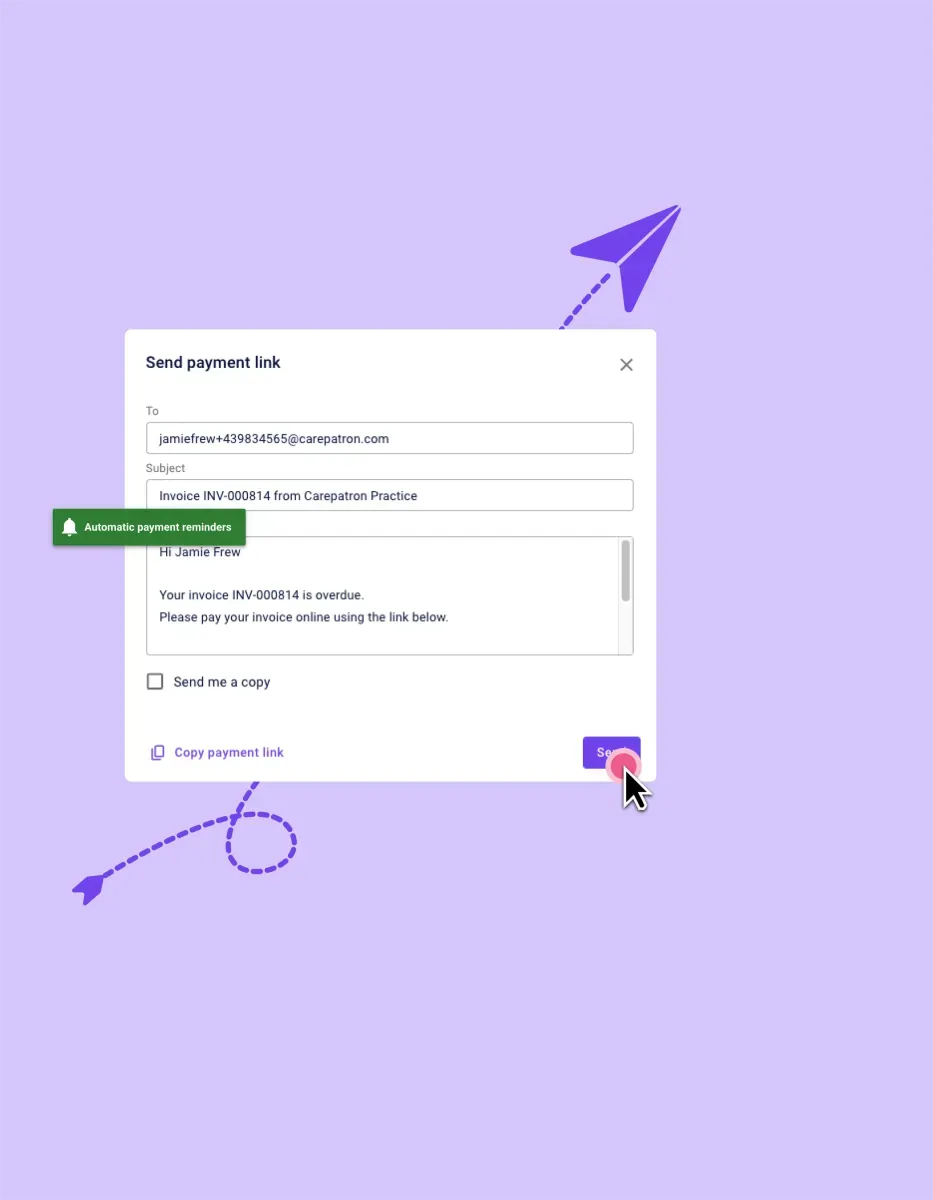

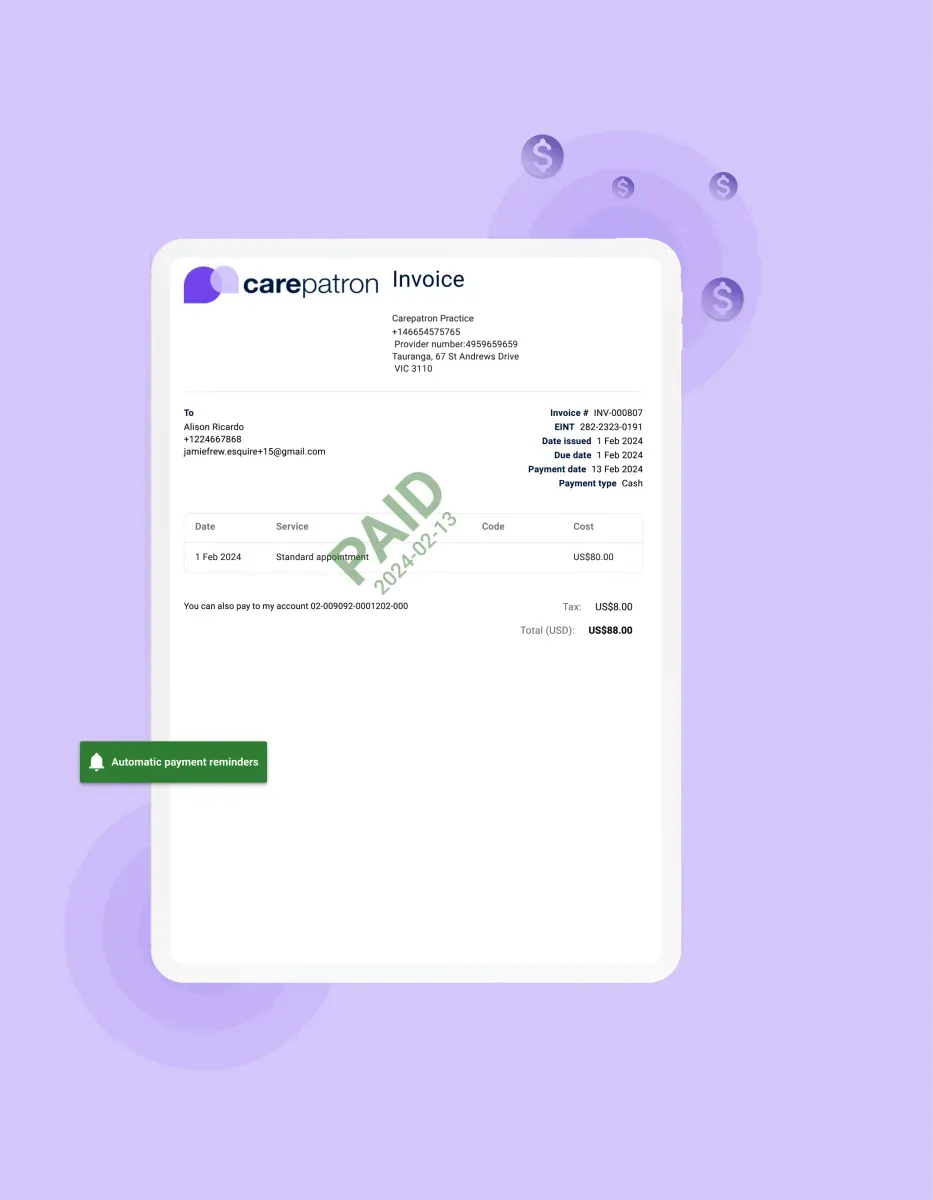

Automated Payment Reminders

Carepatron simplifies payment processes with automated reminders, ensuring timely reimbursements. This feature minimizes the risk of overlooked payments, allowing healthcare providers to focus on delivering exceptional care rather than administrative tasks.

Trusted by more than 100,000 practitioners

"It’s so easy to connect with my staff"

CLAIRE, PHYSICAL THERAPIST

"Carepatron saves me 2 hours everyday"

AEGEUS L, HEALTH COACH

"My team loves how simple it is to use"

ANDREA MAGNUS, PRACTICE MANAGER

The benefits of using our healthcare payment automation platform

Transform the way your practice handles payments. Here are some benefits for you to take advantage of:

Efficiency unleashed

Medical Payment Software streamlines payment processes, reducing manual tasks and administrative burdens. This efficiency allows healthcare professionals to focus more on patient care and practice growth.

Cost-effective operation

Say goodbye to high transaction fees and overhead costs. Medical Payment Software minimizes expenses, directing more funds toward your practice's growth and development, ensuring a financially sustainable and thriving healthcare business.

Fortified security

Medical Payment Software prioritizes data security, safeguarding sensitive patient information and financial transactions. With advanced encryption protocols and secure payment gateways, healthcare providers can trust the integrity of their financial data.

Time savings

Medical Payment Software simplifies and automates financial workflows, reducing the time and effort spent on manual tasks. From invoicing to payment tracking, it ensures accuracy and efficiency in managing your practice's finances.

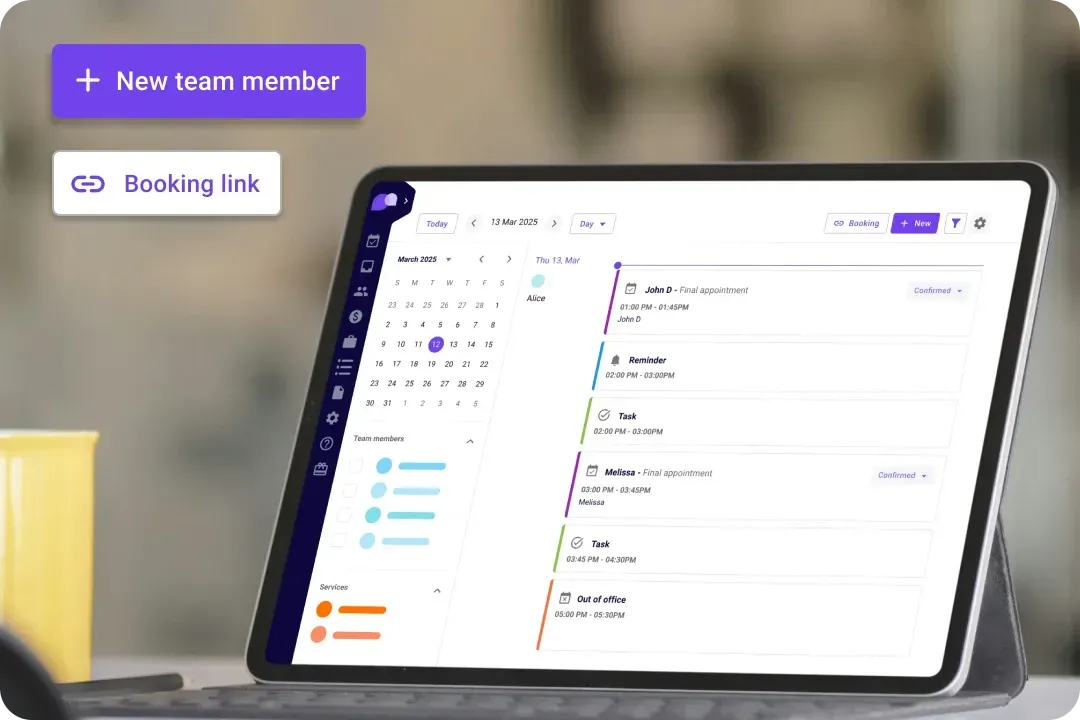

The health care payment system for every healthcare team

We offer a payment solution that works for you. Whether you're a solo practitioner, a clinic, or a growing healthcare team, Carepatron simplifies payments so you can focus on patient care instead of chasing invoices.

Physicians

The Healthcare Payment Solution streamlines billing and payment processes for physicians, ensuring timely reimbursements and minimizing administrative burdens. With customizable features and secure transactions, physicians can focus more on patient care.

Mental Health Counselors

Mental health counselors can utilize the Healthcare Payment Solution to simplify payment processes and enhance client satisfaction. With features such as automated payment reminders and secure transaction systems, counselors can focus more on supporting their clients' mental well-being.

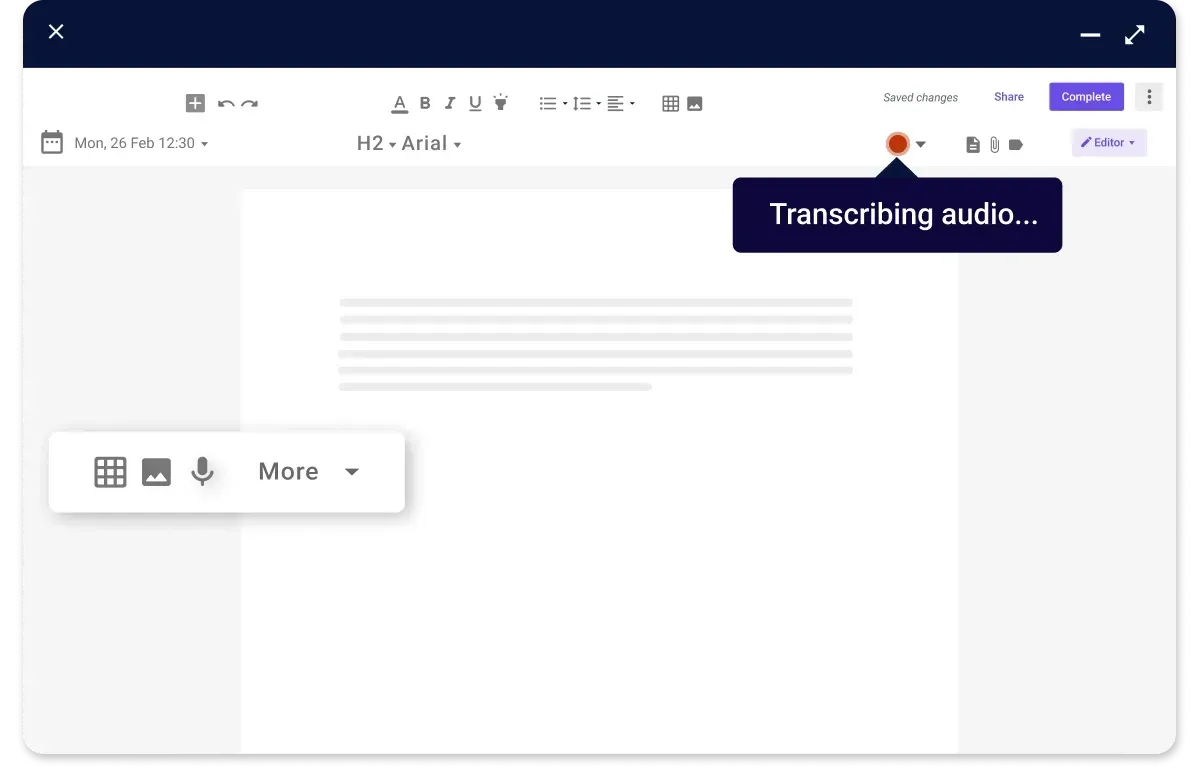

Brief breakdown: How to use our online healthcare payment software

Start with your Carepatron log in with just a few clicks. Here’s how to get started:

Access the Platform

Log in to the platform from any internet-enabled device to access the Online Healthcare Payment Software. With secure credentials, users can access the platform anytime, anywhere, ensuring convenience and flexibility.

Process Payments

Once logged in, users can process payments seamlessly through the intuitive interface. Simply input payment details and authorize transactions, ensuring timely and accurate payments from patients or insurance providers.

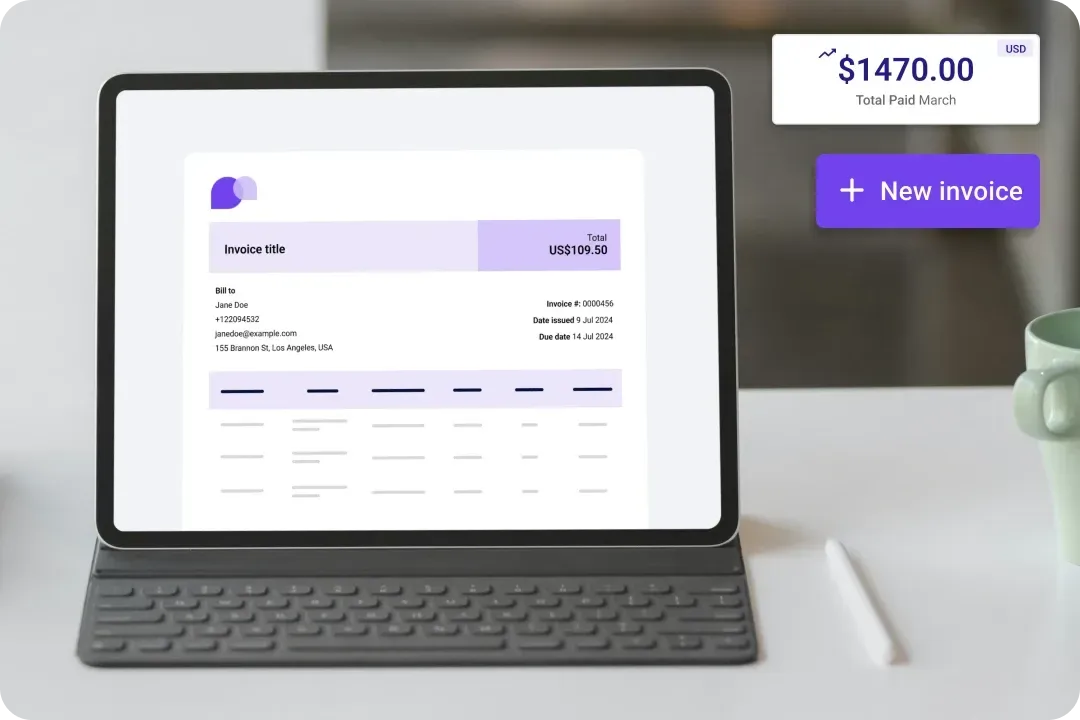

Generate Invoices

Generate customized invoices effortlessly within the platform. Customize invoice templates to include relevant patient and service information, ensuring clarity and professionalism in your billing process.

Frequently asked questions

EHR and practice management software

Get started for free

*No credit card required

Free

$0/usd

Unlimited clients

Telehealth

1GB of storage

Client portal text

Automated billing and online payments