Monthly premiums for Medicare Advantage plans can vary widely based on the provider, coverage options, and region. Unlike Original Medicare, which has standardized Part B premiums for all beneficiaries, Medicare Advantage plans may offer lower or sometimes $0 premium options, but this can depend on the specific benefits covered, such as prescription drug costs.

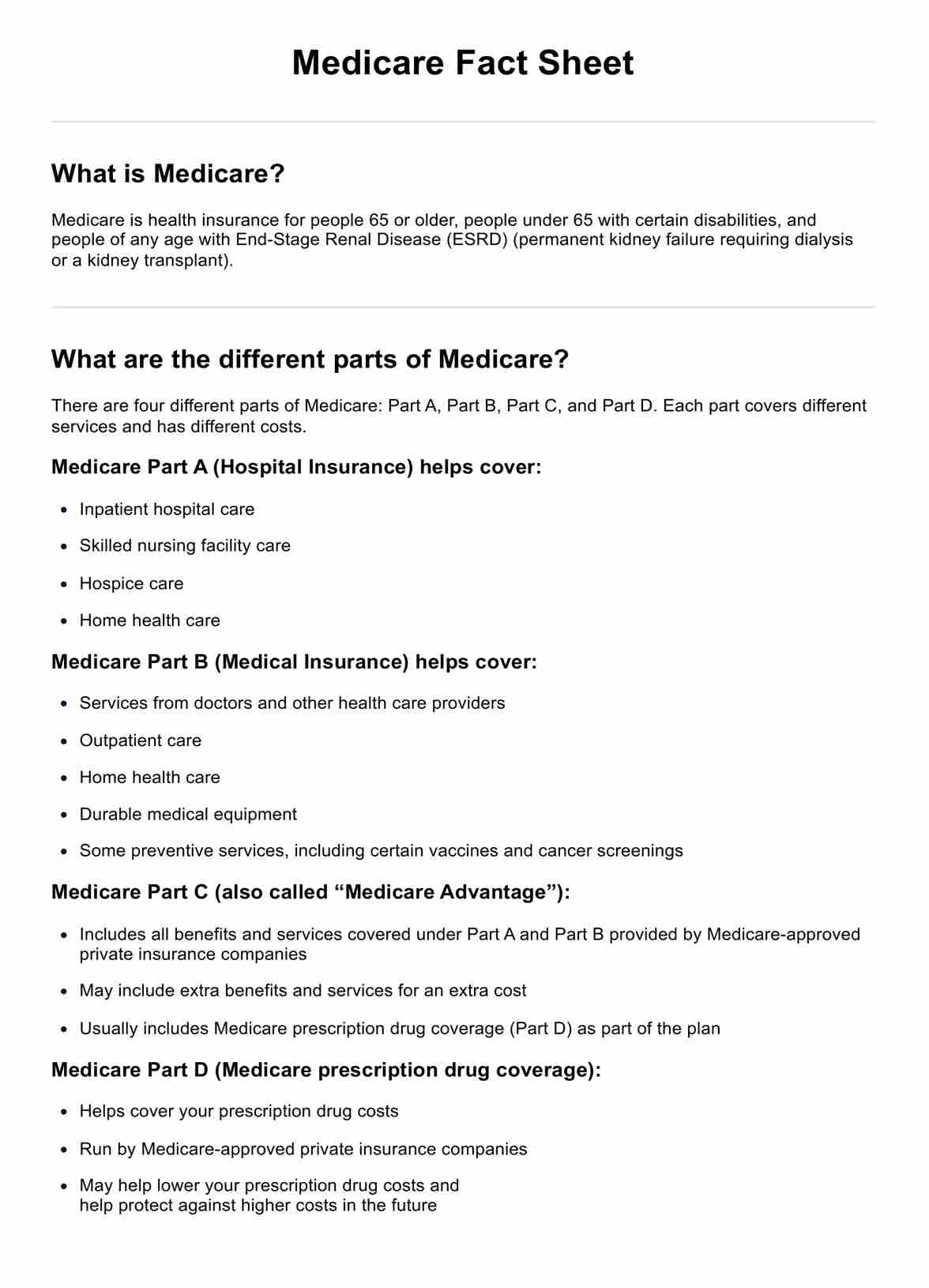

Medicare Fact Sheet

Download a free Medicare Fact Sheet for your patients. Learn how Medicare works with our free template.

Medicare Fact Sheet Template

Commonly asked questions

Yes, Medicare Part D covers prescription drug costs for beneficiaries. Private insurance companies approved by Medicare offers these plans and include a variety of medications at different cost levels.

Medicare taxes are federal payroll taxes collected from employees, employers, and the self-employed. These taxes contribute to funding Medicare Part A (Hospital Insurance). Employees and employers each pay a Medicare tax rate of 1.45% on wages, with self-employed individuals paying the full 2.9% since they cover both the employee and employer portions.

EHR and practice management software

Get started for free

*No credit card required

Free

$0/usd

Unlimited clients

Telehealth

1GB of storage

Client portal text

Automated billing and online payments